Do I qualify? Although Bitcoin is relatively new among the available investment alternatives, it is fast rising in popularity and inching towards the mainstream. Bitcoin Exchanges.

How it works

Some people are betting that in — or whenever they are more gray-haired than today — it’ll be worth a lot. Last year, she invested 15 percent of her retirement savings in cryptocurrencies. Six percent of savers say they would consider using cryptocurrencies as an investment option for their retirement plan, according to a recent survey by Auctus, a platform for retirement planning. Fourteen percent said they were unsure, but interested in the idea. Auctus surveyed more than people in the U.

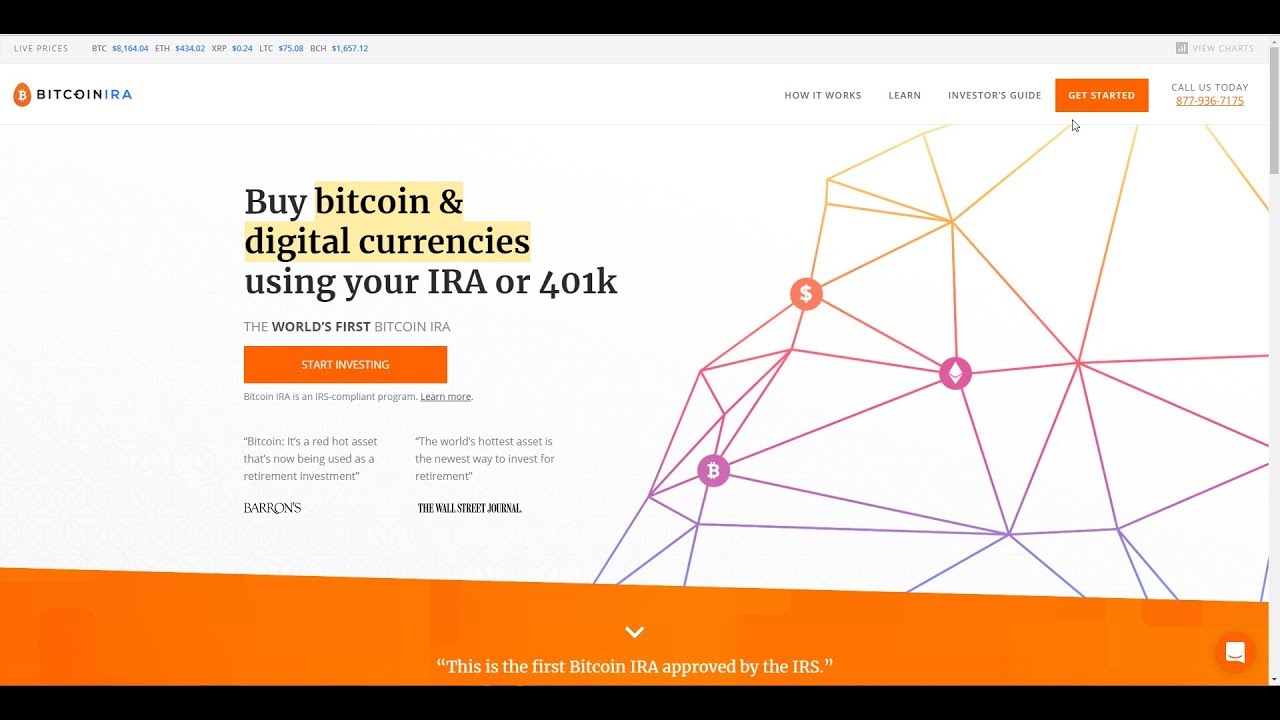

Given its volatile price swings, bitcoin might not be an ideal investment for retirement. Yet an increasing number of financial services firms now offer the option of investing in the cryptocurrency through self-directed IRA accounts. In an interview earlier this year, Bitcoin IRA , one of the earliest providers in this space, claimed that it had already signed up 4, people for its service. Jay Blaskey, the digital currency specialist from BitIRA , says they first started exploring bitcoin for retirement accounts after a IRS ruling categorizing the cryptocurrency as property. The opportunity has grown in the last year.

Given its volatile price swings, bitcoin might not be an ise investment for retirement. Yet an increasing number of financial services firms now offer the option of investing in the cryptocurrency through self-directed IRA accounts. In an interview earlier this year, Bitcoin IRAone of the earliest providers in this space, claimed that it had already signed up 4, people for its service.

Jay Blaskey, the digital currency specialist from BitIRAsays they first started exploring bitcoin for retirement accounts after a IRS ruling categorizing the cryptocurrency as property.

The opportunity has grown in the last year. David Allen, the chief operating officer at Equity Trus t — a Cleveland-based financial services firm that recently introduced bitcoin trading facility through IRA accounts for its customers, says they introduced the service due to demand.

But this year has been a mixed bag for bitcoin. Blaskey says their average customer type has changed from previous years.

To be sure, those savings can be substantial since a capital gains tax, amounting to between 15 percent and too percent, may be applied to all cryptocurrency trades. But the benefits of trading bitcoin through a self-directed IRA account come with their own set of challenges.

The most important one is the expense of added fees and risk. Because firms offering self-directed IRA services are not bound by broker fiduciary duties, investors are on the hook if they do not assess risks associated with crypto markets. Fees for bitcoin trading take on jra forms during the investment process, from initial setup fees to custody nuy trading fees to annual maintenance fees.

There are also recurring custody and maintenance fees charged by providers of such services. For example, Equity Trust charges 3. Then there is can i use ira to buy bitcoin fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. Cumulatively, those fees could negate the tax advantages offered by IRA accounts.

But individual investors can hold onto their bitcoin until retirement to get tax benefits. The recent entry of institutional players like Fidelity may also make a difference to the overall fee structure.

Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. Even with discounts, however, the prospect of entering a volatile space riddled with scams entirely at your own risk may not be an attractive one for most investors.

Investing in cryptocurrencies and other Initial Coin Offerings «ICOs» is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained.

Can i use ira to buy bitcoin of the date this article was written, the author owns 0. Roth IRA. Your Money. Personal Finance. Your Practice. Popular Tp. Login Newsletters. Part Of. Bitcoin Basics. Bitcoin Mining. How to Store Bitcoin. Bitcoin Exchanges. Bitcoin Advantages and Disadvantages. Bitcoin vs. Other Cryptocurrencies. Bitcoin Value and Price. Cryptocurrency Bitcoin. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. Bitcoin Definition Bitcoin is a bitocin or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Direct Rollover Definition A direct rollover is a distribution of eligible assets from one qualified plan to. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins.

CVC (CIVIC)

$100 token valued

Imagine having identity information, money, and #crypto all-in-one. Gamechanger. You have to get on the waitlist for the Civic Wallet app, come join me. #CivicWalletTeam

REGISTER:https://t.co/Ru0oMzmlwb

DOWNLOAD WALLET APPhttps://t.co/Gj0c9qUprP— 🎃Ixkillax🎃 (@ixkillax) October 21, 2019

Here’s what you should be mindful of

Regulators around the world have worked hard to frame appropriate guidelines. Then there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. Most IRAs fall under the category of captive accounts, bictoin limit your investment options to the assets directly offered by bitcion IRA company. Now, Bitcoin has earned acceptance and become more legitimate. Bitcoin vs. The opportunity has grown in the last year. Invest accordingly. It is becoming popular especially in regions which suffer from inadequate banking facilities. Blaskey says their average customer type has changed from previous years. Photo credit: stocksnap. The final step before actually investing your capital into Bitcoin is to fund your Bitcoin wallet using capital from your Usf — and only from your IRA.

Comments

Post a Comment