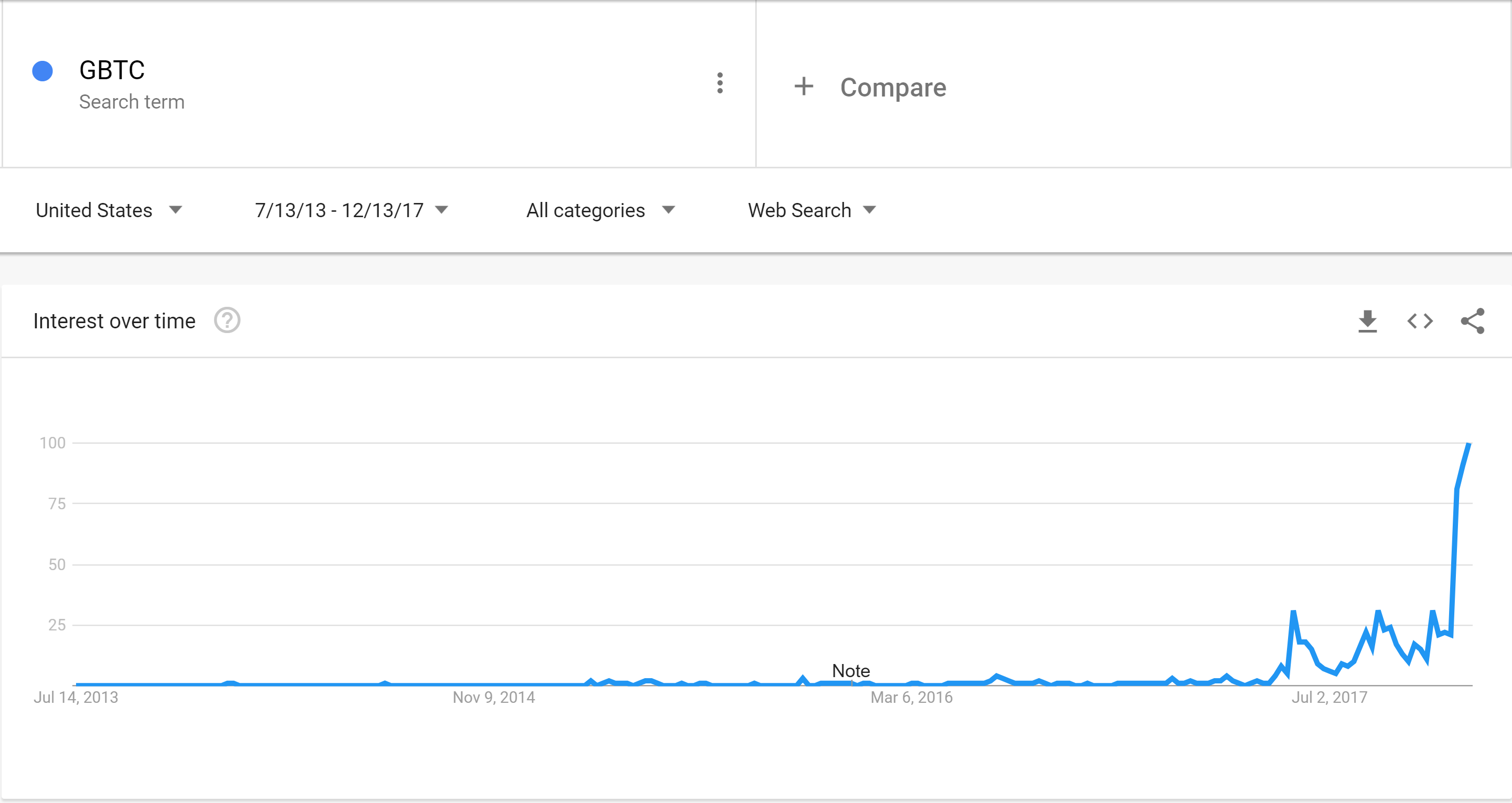

This means that investors have access to buy and sell public shares of the Trust under the symbol GBTC. A private placement is a sale of stock shares to pre-selected investors and institutions rather than on the open market. Because the Trust is currently the only fund of its kind specifically for bitcoin, investors have been paying a high premium.

We’ve detected unusual activity from your computer network

Some seasoned investors may be reluctant to get involved in direct investments relating to cryptocurrencies, or digital currencies, since they’re usually highly speculative, the market is largely unregulated, and storing them safely can be challenging. A trust whose shares trade over-the counter on OTCQX offers investors exposure to Bitcoin through the form of a security. This means that investors have access to knvestment and sell public shares of the Trust under the symbol GBTC. Its success mirrors that of Bitcoin because its value is derived solely from that cryptocurrency. On the other hand, investors are eligible to purchase as little as one share of the GBTC public quotation.

Find out whether this fund is a smart way to play the cryptocurrency boom.

Georgi Georgiev Oct 03, Reportedly, GBTC charges 2 percent on the invested amount as an expense fee, where the average equity mutual fund expense ratio was roughly around 0. Expense ratios are insane for these funds and the current Bitcoin price is creating more problems. Bitcoin BTC 0 0 is currently trading roughly around 60 percent below its all-time high value. In its Digital Asset Investment Report , the company outlined:.

Grayscale Adds Ripple XRP, Litecoin, Ethereum, & BCH to its Investment Trust — Big Money On Its Way!

Titled, auditable ownership through a traditional investment vehicle

They’re even allowed in many tax-favored retirement accounts, and avoiding the need to move money between different types of accounts in order to manage bitcoin and non-bitcoin investments is a big plus. On the other hand, investors are eligible to purchase as little as one share of the GBTC public quotation. There can be no assurance that the grayscale bitcoin investment trust review of the shares will approximate the value of the Grayscale bitcoin investment trust review held by the Trust and the shares may trade at a substantial premium over or discount to the value of the Trust’s Bitcoin. As the Fool’s Director of Investment Planning, Dan btcoin much of the personal-finance and investment-planning content published daily on Fool. Is Grayscale Bitcoin Trust a Buy? New York, Oct. Private Placement: What’s the Difference? For more information, we encourage you to view our FAQs ttust. Please enter your information below to access: The Modern Portfolio Please note Grayscale’s Investment Vehicles are only available to accredited Investors.

Comments

Post a Comment